Fannie mae fnma and the federal home loan mortgage association freddie mac fhlmc. Watch the video to learn more about each of the 4 cs.

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

4 cs of credit when buying a home

4 cs of credit when buying a home is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 4 cs of credit when buying a home content depends on the source site. We hope you do not use it for commercial purposes.

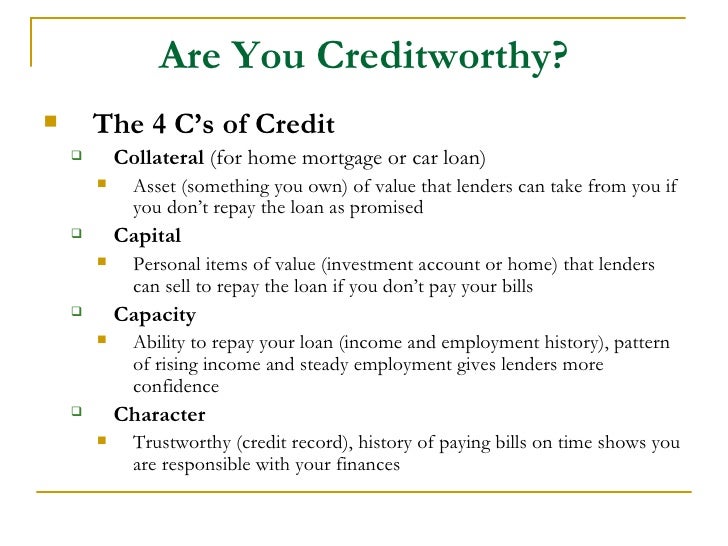

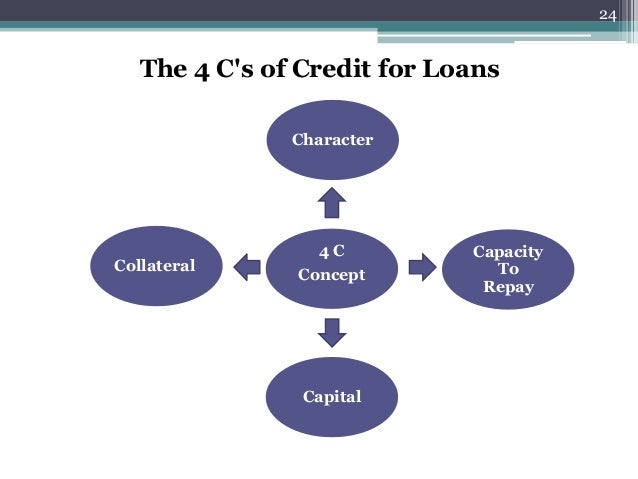

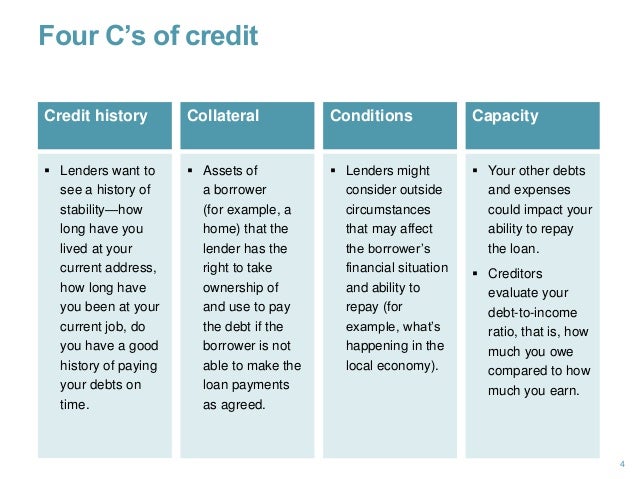

The 4 cs of credit are capacity capital collateral and credit and theyre what mortgage lenders look at to determine credit qualification.

/GettyImages-183008190-60fe565ac5294fbe9813b124c9893dbb.jpg)

4 cs of credit when buying a home. Obviously your ability to pay back a loan is an important factor for a lender when considering you for a loan but different lenders will measure this ability in different ways. 1 credit 2 capacity 3 capital 4 collateral here is a summary of each c and how they impact the loan approval. You must first complete what is a mortgage.

Factors that will affect your credit score include. In evaluating a loan application to determine whether or not an applicant qualifies for a mortgage lenders look at four areas. A high personal credit score over 700 may be the most important factor in getting a business loan.

Before viewing this lesson. Credit capital and collateral march 15 2018 shashank shekhar to understand how the underwriter looks at your information you need a detailed explanation of the remaining three cs. Similarly long and strong credit histories help higher ratiosand good credit and income can overcome lesser down payments.

This is the follow up blog to last weeks entry discussing number 1 of the 4 cs. Of the four cs of credit capacity is often the most important. The rest of the four cs.

Capacity refers to a borrowers ability to pay back hisher loan. Now each of the 4 cs are important but its really the combination of them that is key. The fewer the problems the higher the credit score.

These four areas are known as the four cs and stand for. 4 cs of lending what you should know before buying a home to be able to qualify for a loan to purchase a home lenders review your 4 cs capacity credit capital and collateral to see if you are able to repay the loan. Strong income ratios and a large down payment with strong reserves can offset some credit issues.

The 4 cs of homeownership capacity posted december 11 2014. Character is most often determined by looking at the credit history particularly as it is stated in the credit score fico score. Since our agency will be closed from wednesday december 24 2014 through and including friday january 2 2015 i am combining the last 2 of the 4 cs in this weeks blog.

The 4cs To Securing A Mortgage Fannie Mae Sjr Infographics

The 4cs To Securing A Mortgage Fannie Mae Sjr Infographics

Understanding Your Personal Credit

Understanding Your Personal Credit

4 C S Of Credit Character Onesource Financial

4 C S Of Credit Character Onesource Financial

The 4p S 4 C S In Marketing The Optima Kart World S Largest

The 4p S 4 C S In Marketing The Optima Kart World S Largest

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Making A Homebuying List Checking It Twice Freddie Mac

The 4 Cs Of Qualifying For A Mortgage Freddie Mac

Understand Business Credit And Risk Management Ppt Download

Understand Business Credit And Risk Management Ppt Download

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)